cash tax refund check with two names

The format varies by state for refund checks but IRS joint refund checks are addressed with an and separating the names. Up to 2 cash back Check cashing fees start at 3 with Shoppers Card for checks up to 2000.

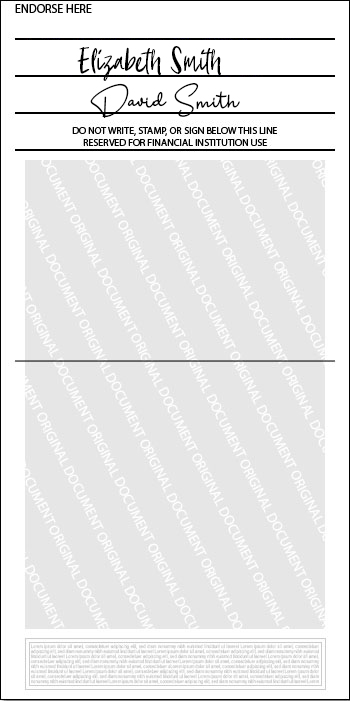

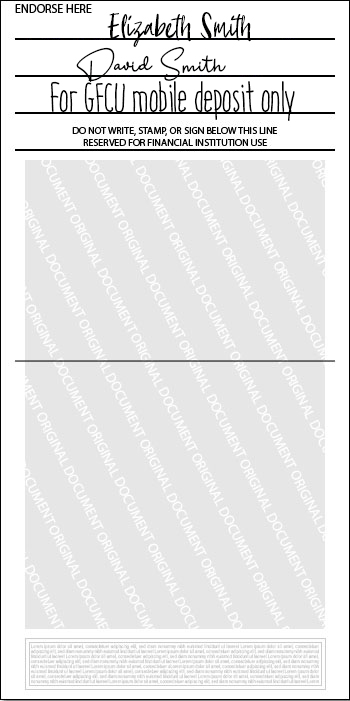

Tips For Depositing Your Government Issued Stimulus Or Tax Refund Check Greenville Federal Credit Union

If you are unavailable to sign its possible for your account co-owner to deposit the check into the account with just one signature and withdraw cash at an ATM.

. Now that tax season has officially begun some Advantis members may receive tax refund checks from the IRS made out to two names. Now that tax season has officially begun some Advantis members may receive tax refund checks from the IRS made out to two names. Also you could use the check to open an account which is.

Most of the year the limit on check cashing is 5000 but from January to April during prime tax refund. By state law the executor or administrator of a deceased persons estate can endorse checks including checks on principal or interest tax refunds or payments for goods and services so it makes sense to bring the check to the. To cash a check with 2 names separated by and contact your bank or financial institution since every bank has its own rules about this.

Policies vary depending on the retailer but you will pay a fee. You can request a direct deposit of your income tax refund into an account that is in your name only. To cash a check with 2 names separated by and contact your bank or financial institution since every bank has its own rules about this.

New York sent a refund check made out to my deceased wife and me. I need Survivors Affidavit form DTF-280. If you file a paper return use Form 8888 Allocation of Refund Including Savings Bond Purchases to split your refund among two or three different accounts.

We might be talking about a 400 check or a 40000 check and the personal representative might take a dim view of the IRS declaring a right of. The location is based on the city possibly abbreviated on the bottom text line in front of the words TAX REFUND on your refund check. The format varies by state for refund checks but IRS joint refund checks are addressed with an and separating the names.

If your refund is issued. For example the Walmart check cashing policy in Texas and elsewhere in the US. MY NAME MOTHERS NAME 111 EXAMPLE ROAD AUSTIN TX.

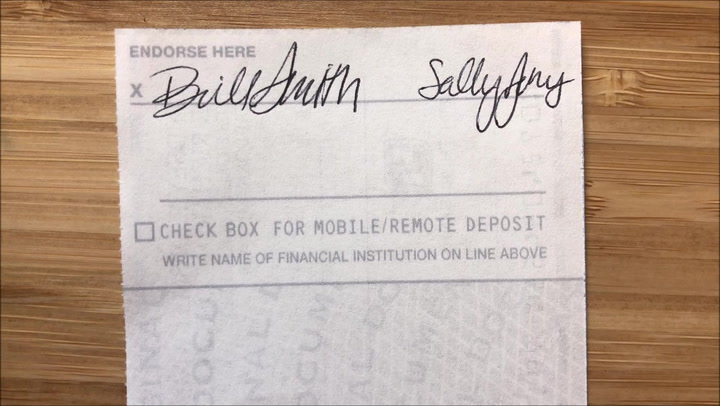

The presence of and or and between names signify whether the couple must cash the check together or whether either party can cash it alone. Most banks will allow this if both parties sign the check. The bank will not accept the check without my wifes signature.

If a check with two names says and on the pay to the order of line then everyone has to endorse the check. Joint Accounts and IRS Checks If you have a joint account the co-owner can cash your refund check on your behalf. Fees limits vary by state.

She cannot sign from the grave. Because banks have strict regulations for cashing checks made out to two parties youll have a lesson in togetherness as you cash a joint tax refund. If you have a bank account your bank will cash your refund check without charging a fee.

Fees for checks between 200001 and 5000 start at 550 with Shoppers Card. Tax Refund Check Payable to Deceased Person - 121504 0628 PM. The amount varies by bank but is typically less than 10.

I endorsed the check. Depending on the banks policy it might require the check to clear before your relative can access the funds. Form 8888 is not required if you want IRS to direct deposit your refund into.

If you dont have one you can cash the check at any bank. If the names are separated by a comma or andor or nothing at all you can endorse and cash the check yourself. You can also arrange for a direct deposit into an account that is owned by your spouse.

Bank of America If it is a tax refund check all payees must also be joint owners of the Bank of America account Chase Wells Fargo Citibank US. Get Help from a Relative. Check your local Money Services.

You can sign a federal tax refund check over to a family member to be cashed or deposited into his account. Some will charge a small fee for the service because you are not a customer. It dictates who can cash a joint check based on how it is written.

The bank cashing the check will probably expect you to exhibit your ID to demonstrate that you have marked the check over to the new beneficiary. I received my US federal tax return earlier this month. Splitting your refund is easy and can be done electronically if you use IRS Free File or other tax software.

Post by Deleted onJun 13 2013 at 805pm. Otherwise any party named on the check can deposit it into his or her. The answer was yes they will cash a check with 2 names with only 1 signature.

Bank Capital One PNC Bank TD Bank If it is a tax. You have the legal right to the proceeds. When I first looked at the check I noticed it had a symbol followed by my mothers name on the line below the one with my name.

If the issuer of the check lists the names with the word or in between them or the names are listed separately one to each line then either person may cash the check without the others permission. And a request that IRS to reissue the check in the name of the survivor. For refunds issued during the second quarter which ended June 30 the IRS will pay 5 interest compounded daily.

When the Internal Revenue Service issues a tax refund to joint taxpayers in the form of a check you will receive the check with both of your names printed on it. If you no longer have access to a copy of the check call the IRS toll-free at 800-829-1040 individual or 800-829-4933 business see telephone and local assistance for hours of operation and explain to the. Youll need to sign the check over to your relative by endorsing the back and writing the words Pay.

Im pretty certain this is in the 24 category. In the support zone behind the check state Pay to the request for on the primary line trailed by the persons name and your name as it shows up on the front of the check. You can sign a federal tax refund.

Imposes a 4 fee on all transactions up to 1000 and 8 for transactions above that amount. Cashing a check with two names on it can be done in one of two main different ways depending on how the names are written out. If the issuer of the check lists the names with the word or in between them or the names are listed separately one to each line then either person may cash the check without the others permission.

Stolen Tax Refund What To Do If This Happens To You Money

Tax Refunds 2022 Why Did You Only Get Half Of Your Tax Return Marca

How To Cash A Two Party Check Without The Other Person With One Signature Etc First Quarter Finance

Tax Filing Season Kicks Off Here S How To Get A Faster Refund

Tax Season Is Here Tips To Get Your Refund Processed Quicker Without Any Delays

Explore Our Image Of Deposit Form For Bill Of Sale Email Template Business Contract Template Email Template Examples

Tips For Depositing Your Government Issued Stimulus Or Tax Refund Check Greenville Federal Credit Union

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Season Wild Guess Giveaway Fun With Tax Forms Can You Guess How Many Pieces Of Paper Are In This Jar For A Cha American Express Gift Card Jar Tax Forms

Professional Mechanic Deposit Template Doc Sample Being A Landlord Professional Cover Letter Template Simple Cover Letter Template

Irs Tax Refunds How To Check Your Stimulus Payments History In 2022 Irs Taxes Income Tax Return Tax Refund

Inflation Ruining Your Budget 3 Clever Ways To Save While Shopping And More In 2022 Child Tax Credit Irs Taxes Tax Refund

Beware Of The United States Treasury Check Scam

Can I Receive A Refund From The Irs For Overpaid Taxes San Jose Ca Tax Lawyer

Stimulus Checks White House Agrees To Tighten Eligibility Rules For 1 400 Direct Payments Sources Tax Forms Tax Irs

What Is A Two Party Check Where Can You Cash It Mybanktracker

Get Our Example Of Direct Deposit Payroll Authorization Form Payroll Legal Questions Being A Landlord